Our research framework for positioning and messaging

Without structured research and analysis, many companies rely on ad hoc methods, personal experience and opinion for their positioning and messaging decisions. There’s a better way.

Over the course of working with hundreds of companies on positioning and messaging, including 85+ that were acquired or went public so far, we evolved a disciplined and effective way of gathering and analyzing information to support the collaborative positioning and messaging work we do with our clients, and often their agencies too. We’ve found that comprehensive,. organized research and discussions in a workshop setting helps keep efforts more focused, objective and ultimately, successful.

Here are the 5 steps in our Accelerant research approach:

1. Review solid analyst reports for the category (or categories) the company belongs to

2. Select three top competitors from the (or each) category and review/analyze their positioning and messaging from:

a. Web sites

b. LinkedIn, Facebook, Twitter, Instagram Glassdoor pages

c. Social media profiles and posts

d. Ads running on social platforms

e. Videos on Web sites, YouTube and other video sites

f. Search returns on company and important keywords

g. News search

You should use generative AIs to help with the process. But doing the direct content sourcing work yourself will immerse you in the language, imagery and support assets among the competitive cohort of companies that AI can’t provide. Direct contact will also give you a check on the accuracy of what AI brings back Also, AI isn’t at the state yet where it can provide the comparative analysis that experts can, but using both direct sourcing and AI is productive for comprehensiveness and cross-checking accuracy.

Attempt to determine the clarity, authenticity and persuasiveness of the companies’ approach to describing aspects of the problem they solve, their positioning and their related messages around it. Make note of important observations and insights that could present an advantage to your company.

Here’s our positioning framework:

3. Create a draft Positioning & Messaging report with the highlights of your review and analysis of relevant analyst reports, along with your profiles and analysis of each competitor.

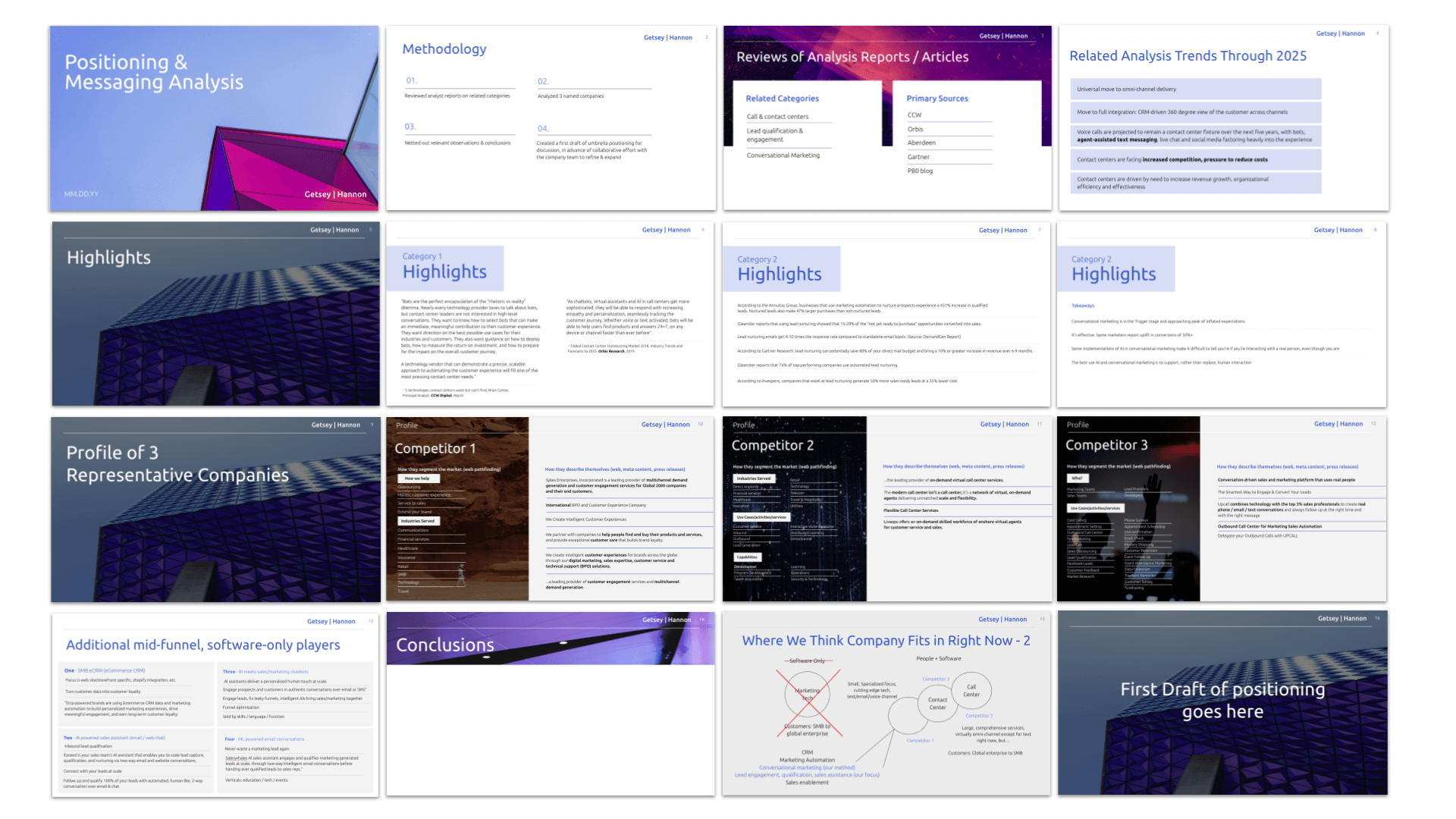

Here’s what a positioning report of ours looks like:

Here’s the structure of the competitor profile we use:

4. Review your draft report, then plot each category and related company in space with a diagram and analysis like this to see where everyone fits and where spaces for opportunity might exist. The character of what each axis represents varies from category to category, and we often create more than one diagram if there are different material “lenses” through which competitive cohorts of companies can be viewed. Once you’ve thought through where others are, and where your company actually sits, create a full report.

Here’s what a category visualization of ours looks like:

5. Once you’ve done your research and analysis, created a report, and shared it with your teammates and decision-makers, you should be able to create a first stab at positioning. Just follow the framework from Step 2 above. Then workshop with your team. We find that 3 sessions or so, each pressure testing and iterating on the thinking from preceding sessions, usually gets you to an agreement, or very close.

Taking a structured research approach to the front end of positioning will save you a lot of time and trouble in prepping your team to collaborate and generate ideas for positioning and messaging. You can read about our collaborative approach to positioning here.

Thanks for reading. We hope you found this helpful. Please get in touch with any comments, questions or additional thoughts.